Submitting the correct PMEGP loan documents is essential for a smooth and successful loan approval in India. Many applicants face delays due to incomplete or missing papers. Key documents required include identity proof (Aadhaar card, PAN card), address proof (ration card, voter ID), bank statements, project report, and entrepreneurship training certificates. Having these documents ready ensures the application process is hassle-free and increases the chances of approval. This guide provides a complete overview of all mandatory and supporting PMEGP loan documents, helping entrepreneurs across India prepare accurately and submit their applications confidently in 2025.

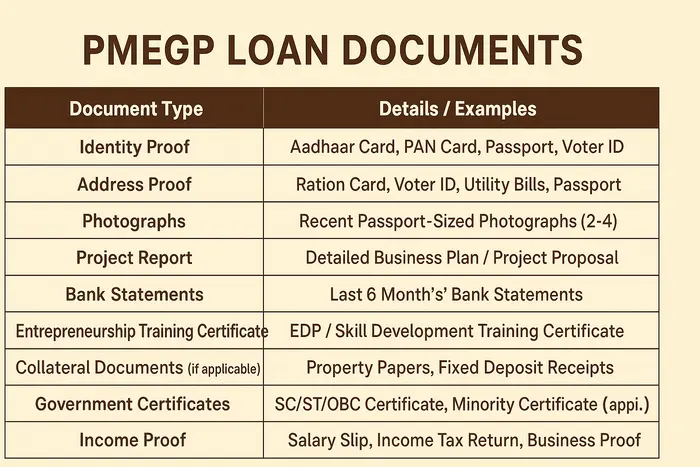

| Document Type | Details / Examples |

|---|---|

| Identity Proof | Aadhaar Card, PAN Card, Passport, Voter ID |

| Address Proof | Ration Card, Voter ID, Utility Bills, Passport |

| Photographs | Recent Passport-Sized Photographs (2–4 Copies) |

| Project Report | Detailed Business Plan / Project Proposal |

| Bank Statements | Last 6 Months’ Bank Statements of Applicant |

| Entrepreneurship Training Certificate | EDP / Skill Development Training Certificate |

| Collateral Documents (if applicable) | Property Papers, Fixed Deposit Receipts |

| Government Certificates | SC/ST/OBC Certificate, Minority Certificate (if applicable) |

| Income Proof | Salary Slip, Income Tax Return, Business Proof |

| Other Supporting Documents | Partnership Deed, MOA, Lease Agreement (if applicable) |

Key Documents Required for PMEGP Loan

The Indian government mandates a set of PMEGP loan documents to verify the eligibility, financial status, and business plan of applicants. Submitting incomplete or incorrect documents can lead to delays or rejection of your loan application. Below is a detailed overview of the essential documents:

Eligibility Criteria and Document Verification

The PMEGP scheme is open to both rural and urban entrepreneurs, with specific guidelines for self-employment. The document verification process ensures that applicants meet the eligibility criteria. Here’s what officials check during verification:

- Identity & Age: Proof like Aadhaar or Voter ID ensures that the applicant is a resident of India and within the eligible age range.

- Educational Background: Certain types of business projects require proof of minimum education level.

- Financial Status: Bank statements and income certificates help determine the loan subsidy and repayment capability.

- Business Feasibility: A well-prepared project report or business plan shows the applicant’s readiness and potential for success.

Step-by-Step Process to Gather PMEGP Loan Documents

To ensure a hassle-free application, follow these steps to prepare your PMEGP loan documents:

- Collect Identity & Address Proofs: Gather Aadhaar card, PAN card, voter ID, and any recent utility bills.

- Prepare Educational Certificates: Include mark sheets, diplomas, or degrees relevant to your business field.

- Draft a Detailed Project Report: Include business objectives, capital requirements, expected returns, and operational plans.

- Open / Verify Bank Account: Ensure your bank account is active, with a proper transaction history to showcase financial credibility.

- Gather Income & Caste Certificates: These certificates can be obtained from local government authorities or online portals.

- Photographs & Signature: Take recent passport-sized photographs and a scanned copy of your signature for submission.

- Review Industrial Licenses or Registrations: Certain enterprises require prior registration or licensing to qualify for PMEGP loans.

Common Mistakes to Avoid While Submitting PMEGP Loan Documents

Even minor errors in PMEGP loan documents can delay approval. Here are the most common mistakes applicants make:

- Incomplete Forms: Missing sections in the application form can lead to rejection.

- Expired Identity / Address Proofs: Ensure all documents are valid and updated.

- Incorrect Bank Details: Double-check account numbers and IFSC codes before submission.

- Low-Quality Photographs or Scans: Submitting unclear documents may require resubmission.

- Missing Project Report Details: A vague or incomplete business plan can reduce chances of approval.

By avoiding these errors, applicants can ensure faster processing and higher chances of receiving PMEGP loan benefits.

Digital Submission of PMEGP Loan Documents

In 2025, the Government of India encourages online submission for PMEGP loans. Applicants can upload their documents through the official KVIC e-portal. Here are the benefits:

- Faster Processing: Digital submissions reduce paperwork and allow quicker verification.

- Tracking Made Easy: Applicants can track the status of their application online.

- Secure Storage: Documents are stored securely on the government portal, reducing the risk of loss.

Important Tip: Ensure that scanned copies are clear, legible, and within the prescribed file size limits to avoid upload errors.

Tips for Preparing a Successful PMEGP Loan Application

- Double-Check All Documents:Cross-verify each document for authenticity and completeness.

- Create a Comprehensive Project Report: Highlight financial projections, market analysis, and expected growth.

- Keep Multiple Copies:Have at least two sets of all documents—one for submission and one for reference.

- Consult Local KVIC/Banks: Officials can provide guidance on mandatory documents and best practices.

- Maintain Financial Records: Keeping updated bank statements and income records strengthens your loan application.

Benefits of Submitting Proper PMEGP Loan Documents

Submitting accurate and complete PMEGP loan documents comes with several benefits:

- Quick Loan Approval: Verified documents speed up the approval process.

- Subsidy Claim: Proper documentation ensures eligibility for government subsidy under PMEGP.

- Avoid Rejection: Complete and correct documents reduce the risk of application denial.

- Smooth Business Start: Timely loan disbursal allows entrepreneurs to commence operations without delays.

PMEGP Loan Documents Checklist

To make it easier for applicants, here is a simple checklist to ensure nothing is missed:

- Identity Proof (Aadhaar, PAN)

- Address Proof (Utility Bill, Ration Card)

- Age Proof (Birth Certificate, School Certificate)

- Educational Certificates

- Bank Account Passbook / Statement

- Project Report / Business Plan

- Income Certificate

- Caste Certificate (if applicable)

- Industrial/Trade License

- Passport-sized Photographs

Conclusion

For entrepreneurs in India, the PMEGP loan is a golden opportunity to start or expand a business with government-backed financial assistance. However, the key to a smooth and successful application lies in properly preparing and submitting all PMEGP loan documents. By understanding eligibility criteria, following the step-by-step document preparation process, and avoiding common mistakes, applicants can ensure timely approval, access subsidies, and set a strong foundation for their entrepreneurial journey in 2025.

Read More: PMEGP Application Status 2025—Check Your Loan Status Online Instantly

Read More: PMEGP Scheme ( 2025 New Update )

Verified Portals for Public Interest

- 1stHEADLINE.COM — Stay updated with top news, entertainment, and current affairs. Trusted journalism meets verified updates.

- MYTAMPANOW.COM — Local Tampa news and community stories. Your city, your headlines.

- EDPTRAININGS.IN — EDP and PMEGP training resources designed for entrepreneurs across India.

- 99FABRICS.IN — Premium supplier of lining, canvas, and jute materials trusted by garment professionals.

- WBINDIA.IN — Easy access to simplified updates on Central and State Government welfare schemes.

- KHADYASATHI.IN — Official West Bengal food and ration services portal for citizens.

- RATIONCARDINDIA.COM — Nationwide guide to ration card details, status updates, and EPDS services.

- EPDS2.RATIONCARDINDIA.COM — Reliable access point for public distribution and ration services.

- BANGLASTUDENTCREDITCARD.IN — State-backed education loan details for students in West Bengal.

- PURIHOTELBOOKING.CO.IN — Discover and book verified hotels and accommodations in Puri, Odisha.

- BANGLASHASYABIMA.NET.IN — Accurate details on crop insurance and benefits for West Bengal farmers.

- FIRSTHOMEOWNERGRANTS.COM — Helping first-time buyers in Australia with home grants and property insights.

- REGOCHECKER.COM — Quick car registration and history checks for Australian vehicle owners.

- USAFEDERALGRANTS.COM — Federal grant programs and financial aid opportunities in the United States.

- CARDYATRA.COM — India’s go-to platform for comparing credit cards, offers, and financial products.

- PMEGPEPORTAL.COM — A transparent source for checking your PMEGP loan status and progress.

- BESTUSCARACCIDENTLAWYERS.COM — Find trusted legal professionals specializing in car accident claims across the US.

Pingback: PMEGP Scheme Eligibility 2025 – Official Guide To Easily Secure Your Government Loan | PMEGP E-Portal